By Hirander Misra, Chairman, GMEX Group & MINDEX Holdings

As the market for digital assets evolves, custody solutions customised to the industry are the need of the hour. Hirander Misra explains how digital assets can be brought to market on regulated exchanges and stored in regulated digital custodians, delivering a level of security and oversight not previously available.

Cryptography-based digital assets have become one of the most disruptive and revolutionary technologies since the advent of the internet.

Digital assets are becoming increasingly recognised as an investable Source-of-Value, tradable on global licensed exchanges and accessible to a broad swathe of individuals and institutions across the globe.

Needless to say, just as with stocks, bonds or commodities, investors will want to keep these assets safe from theft or loss.

Digital assets demand digital custody solutions

The market for digital assets has evolved substantially – from cryptocurrency origins as a Peer-to-Peer system of value transfer, to the development of smart contracts and countless other blockchain applications.

As the industry has evolved, solutions aimed at keeping digital assets safe have continued to develop. Enhancements to offline storage, multi-signature protocols, and other security measures are aimed at increasing investor’s confidence that their assets are secure.

Fully institutional custody solutions are needed to hold digital assets securely, solutions that are as robust as those provided for traditional assets. Most digital assets function as cryptographic bearer instruments, with an associated key, which if lost or stolen renders the asset inaccessible and unrecoverable to its rightful owner, making secure custodianship of primary importance.

Custody catching up with the digital asset boom

With asset tokenisation increasing, the capital markets have shown a booming appetite for integrating digital assets into the wealth management portfolio in a comprehensive and seamless manner. Institutional investors are increasingly committing funds to digital assets and require custodians who are able to deliver exchange custody, self-custody or third-party management of their digital asset accounts.

The new cryptocurrency and digital asset exchanges are looking to expand liquidity and attract new participants. For this purpose, they require custodian partners who are able to scale technology to meet the needs of the institutional market. The rapidly increasing value of digital assets demands better security.

Custody solutions for these asset types are particularly technological, requiring new and different approaches based on sound principles. In many ways, the creation of cryptocurrencies and underlying blockchains have changed the potential nature of custody and asset ownership. Blockchain technologies enabling the confirmation of transactions without the need for centralised verification allow questions of asset ownership to be answered more efficiently and with more clarity than in the past.

The ability to instantly and accurately identify who owns a particular asset without requiring a third-party intermediary will have a profound impact on financial services transactions, including the clearing and settlement of securities and other asset transactions.

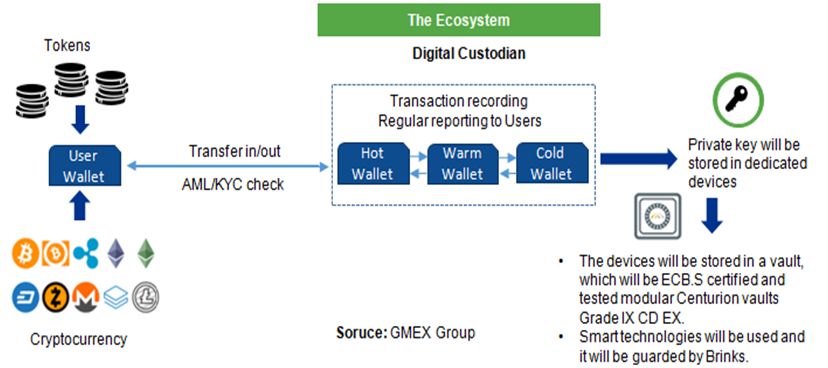

Diagram : Key facets of a digital custody ecosystem

Digital custody to replicate real world storage solutions

Learning from the physical world, it is likely that not all digital wallets/digital vaults will be offered and designed with the same security, compliance, controls and ultimately trust point of view in mind. In the physical world there are already a spectrum of vaults/wallets – ranging from extremely secure bullion warehouses, individual bank branch safes/vaults, to a bank’s individual cashier’s tills, to ATMs and ultimately personal wallets/purses.

In the digital asset world as well, this spectrum of vaults/wallets with different trust and service profiles will have similar patterns. For lower value assets, a software wallet may be the best solution, whereas for very high value assets, storage in a secure vault with certifications such as FIPS 140-2 Level 4 and EAL5+ would be the better choice.

These digital vaults will be online/hot to be able to adapt to market movements and need to be highly secure and designed for a large number of threats and attack vectors. Critically these services must prevent insider administrator attacks and also secure the complete business/IT change lifecycle process to ensure malicious code is not injected into the offering that could threaten the assets in the vault.

A key aspect of FIPS 140-2 Level 4, for example, is the level of tamper resistance, detection and environmental failure protection. These include the detection and reaction to side channel attacks, temperature attacks, probing, drilling and x-ray proton beam attacks, in extremely short periods of time. IBM’s LinuxOne Crypto and Secure Container Services is a prime example of such a foundation service.

This, integrated with digital custody software solutions such as GMEX’s ForumCustody, running on the likes of Hyperledger Fabric or IBM Blockchain Protocol (IBP), can offer institutional grade safe storage and custody not previously available without the need for multi-signature protocols. This allows assets to remain electronically available within a secure environment so that they can be bought and sold without the need to bring them online from an offline physical vault where they are cold stored. In the event an asset holder requires part or all of his assets to be cold stored, this should also be available as an option. The key is to provide user-driven choices.

Digital Custody evolves to secure investor trust

It is clear that digital assets will increasingly be brought to market on regulated exchanges and stored in regulated digital custodians, delivering a level of security and oversight that has not previously been available.

Such a structure should not only offer safe storage for cryptocurrencies but also proper legal nominee and escrow arrangements for underlying assets being tokenised, such as securities. Valuations should be overseen by established audit companies, in the case of new issuance, or a credible custodian, in terms of ongoing portfolio valuation and administration.

As the technology surrounding digital custody solutions evolves, it will help build trust for investors, whether they are high net worth, traditional buy-side or retail investor, and make digital custody the preferred choice for storing digital assets.