By Hirander Misra, Debbie Li and Ruhi Misra, ZERO13

The environmental impact of blockchain’s energy consumption has raised concerns globally. However, the use of renewable energy sources within the Bitcoin space demonstrates a commitment to addressing these concerns. Although the blockchain industry is not nascent, we have seen an increasing number of ESG initiatives emerging that leverage the numerous benefits of blockchain technology, showcasing the industry’s commitment to mitigating its environmental footprint.

To ensure an environmentally and economically sustainable future, we should explore and dispel the myths surrounding blockchain’s energy use, so we can aptly recognise the potential to drive positive change in both environmental and social dimensions while emphasising the importance of interconnection and data sharing in the industry.

Debunking blockchain myths

Myth 1: Blockchain’s energy intensity and market participants

There is a common assumption that only environmentally nonconscious individuals and specific industries engage in cryptocurrencies due to their energy-intensive nature. However, the reality is that cryptocurrencies attract participants from diverse backgrounds and industries. The accessibility and potential for financial growth in the industry appeal to a wide range of individuals, contributing to its adoption in environmentally conscious circles and beyond.

Myth 2: Blockchain’s sole focus is crypto

Blockchain technology is often solely associated with cryptocurrencies, neglecting its broader social impact and positive ESG goals. Beyond crypto, blockchain has the potential to revolutionise supply chains, enhance transparency, and promote sustainability. Recognising the multifaceted benefits of blockchain technology is pivotal to realise its full potential in driving positive social change and achieving ESG goals.

Balancing the direct and indirect environmental impacts of blockchain

We should also emphasise the importance of addressing both the direct and indirect impacts, particularly in the Bitcoin mining sector. While controlling the infrastructure and mechanisms may be challenging, taking responsibility for the environmental impact is essential. There are multiple ESG initiatives—such as Zumo’s Oxygen and GMEX Group’s ZERO13—whose methodology offers organisations, including banks, a valuable tool to address the carbon impact of their assets, promoting transparency and accountability within the financial sector.

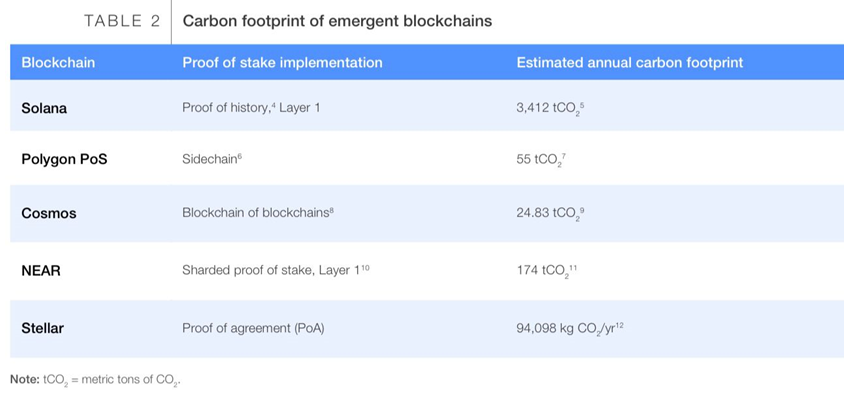

Reducing energy consumption is a critical aspect of ESG efforts. In the public blockchain community, where there is no central authority to drive progress, the value of both proof of stake and proof of work mechanisms should be recognised to verify that algorithms and processes are indeed related to environmental impact. We are beginning to see some blockchains better assess their energy usage and carbon footprint. This balance validates the integrity of carbon credits and fosters sustainable practices in the industry. In this regard, the Guidelines for Improving Blockchain’s Environmental, Social and Economic Impact INSIGHT REPORT APRIL 2023 by the World Economic Forum are very insightful.

The table above from this World Economic Forum report outlines the estimated annual carbon footprint for various proof of stake blockchains. It is interesting that Cosmos as a layer 0 blockchain, which we at ZERO13 utilise for our ZERO13 Chain (underpinned by Pyctor) to connect multiple private and public blockchains as a trading and settlement ‘network of networks’ for digital carbon credits and real-world climate-related assets, has the lowest carbon footprint amongst the list.

Interconnection, data sharing and geopolitical understanding

Interconnection and data sharing play vital roles in tracking and verifying carbon credit projects, especially when it comes to assessing the credibility of the industry. Engaging and collaborating with various stakeholders becomes essential, considering the diverse interests and the need for end-to-end provenance. Understanding the geopolitical dynamics of carbon credit markets, where developing countries primarily produce credits while developed countries consume them, helps foster collaboration and innovation. For example, carbon-negative Costa Rica generates credits, while the UAE and Saudi Arabia buy credits to offset the oil produced by Adnoc and Aramco respectively. The oil companies are increasingly moving into green energy production too in the drive to achieve net zero. For example Adnoc, who are on both the buy and the sell side, recently set up a carbon trading desk. The emergence of digital registries that promote transparency and accountability whilst connecting into multiple digital measurement, reporting and verification standards (dMRV) upstream, and multiple markets downstream, holds significant promise for the future of the industry.

Mining Bitcoin for social and economic benefits

The impact of blockchain technology extends beyond cryptocurrencies. Bitcoin mining, despite its energy-intensive nature, can be harnessed to generate economic drive and commercial benefits. Moreover, it can contribute to social initiatives, which leads to positive change. In Mexico for instance, a mangrove project focuses on ecosystem preservation, carbon credits, and community involvement. Tracking and transparently distributing profits from the primary and secondary sales of carbon credits back to the community using cryptocurrencies essentially ‘banks the unbanked’, and contributes to the concept of “social carbon” and equitable distribution. Blockchain technology allows for transparency and accountability in such practices where legally binding contracts are (sometimes) not enough to track the distribution.

Seaweed farms are also an interesting system to explore. Seaweed absorbs carbon and offers environmental benefits. Whilst Seaweed farming is a nascent industry globally, a report published in Nature Sustainability earlier this year cites that if seaweed could expand to form 10% of human diets by 2050 it could result in a reduction in the amount of land needed for food production by 110m hectares (272m acres), equivalent to an area twice the size of France. Blockchain can ensure fair profit distribution to labourers, enhance transparency in supply chains, and enable producers to verify the origin and ethical standards of seaweed. It becomes a win-win situation: more seaweed farms mean more carbon absorption, with the added benefit of improving the treatment of farmers. Funds from social carbon systems can be redistributed back to individuals by allocating a portion of the proceeds to improve the quality of life. This can be done by investing in infrastructure and facilities that benefit the local communities, including the development of industry-related facilities which can generate stable income and support the growth of sustainable products. By prioritising economic sustainability and community development we can create a more inclusive and prosperous future. Additionally, by examining chemical components, such as conducting lifecycle assessments, the environmental impact of products and assets can be measured more effectively. For example, studies on how effective different varieties of seaweed are at absorbing carbon would directly alter their price and any possible profit.

Another interesting point to consider is water, not as a finite and scarce resource, but rather in trying to avoid its treatment as a commodity like oil, which is an impending concern. Big corporations such as clothing manufacturers and drinks companies are under pressure to address their water usage, especially in product manufacturing. To address the water scarcity issue, they are willing to finance the upstream replenishment of water, including distributed community-based water projects. To support this, blockchain technology can facilitate decentralisation, harness finance, and support upstream developments. We can validate sustainable water management practices by tracking and tracing financial projects related to water usage to ensure transparency, avoid greenwashing, and promote responsible corporate practices.

Looking Ahead: bridging traditional carbon markets and Blockchain

As the worlds of traditional carbon markets and blockchain converge, challenges and opportunities arise. Whilst some assume that carbon emitters solely purchase and use credits, initiatives like Adnoc’s carbon credits trading desk in Abu Dhabi challenge this notion. We simply cannot switch off oil production overnight as it would lead to economic ruin. We have seen the adverse impact of the restricted supply of fossil fuels due to gas pipeline interruptions from Russia supplying fuel to Western Europe. As such it is very much a process, rather than a single event, to move to greener energy. By allowing the sale and purchase of oil and the generation of credits, it demonstrates the potential for synergy between industries. We are transitioning towards greener production methods, meaning that the generation of carbon credits will inevitably increase, promoting a more sustainable future.

Addressing the energy-intensive nature of the blockchain industry and technology services as part of a broader strategy, alongside recognising the wider social impact and positive ESG goals, are crucial steps towards building a more sustainable future. Through the use of renewable energy sources, initiatives like Oxygen and ZERO13, and a focus on economic and social benefits, we can ensure the responsible growth of carbon and wider climate-related markets by leveraging blockchain technology. We can drive transformative change and create a more sustainable and equitable world through more efficient water management, mangroves and seaweed farms – just to name a few initiatives.