What is SECDEX?

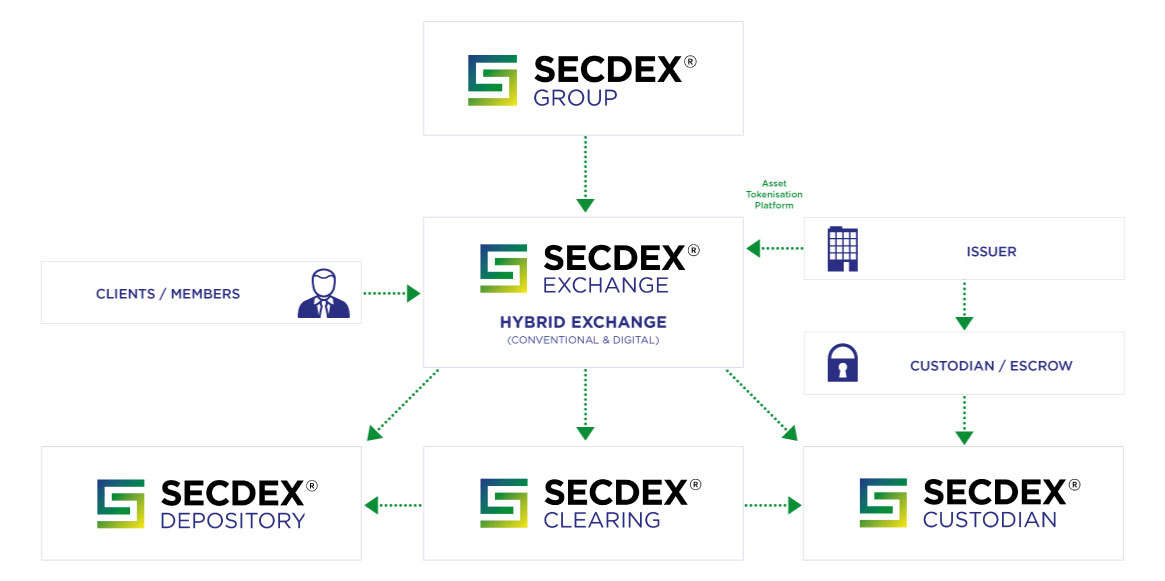

Securities, Commodities and Derivatives Exchange (“SECDEX”) is a market infrastructure ecosystem located in the Seychelles. The SECDEX Group business includes an exchange offering traditional and digital assets, a central counterparty clearing house (CCP) and a central securities depository with registry authorised and regulated by the Seychelles Financial Services Authority (FSA). SECDEX also operates a digital custodian regulated under the sandbox of the Seychelles FSA to custody digital assets.

The multi-asset hybrid exchange (‘’SECDEX Exchange’’) combines the benefits of a digital exchange with those of a traditional exchange. SECDEX Exchange focuses on securities, debt, real-world assets (RWAs) such as spot commodities, carbon credits and derivatives contracts in traditional and digital form.

SECDEX Group Limited (“SECDEX Group”) enables the SECDEX ecosystem.

SECDEX Exchange Limited (“SECDEX Exchange”) is authorised and licensed by the Seychelles FSA to operate a regulated securities exchange with multi-asset capabilities, which include derivatives and digital assets.

SECDEX Clearing Limited (“SECDEX Clearing”) is authorised and licensed by the Seychelles FSA to operate a regulated central counterparty (CCP) clearing house to clear trades executed on SECDEX Exchange.

SECDEX Depository Limited (“SECDEX Depository”) is authorised and licensed by the Seychelles FSA to operate as a regulated central securities depository and registry for securities listed on SECDEX Exchange.

SECDEX Digital Custodian Limited (“SECDEX Custodian” or “SDC”) regulated under the sandbox of the Seychelles FSA to offer digital custodian services for a broad range of real-world digital assets such as securities, commodities and carbon credits (“SDC Digital Custodian”).

SECDEX Digital Marketplace (“SDC Digital Marketplace” or “SDM” or “SECDEX Marketplace”) operates as part of SDC as a trading venue for real-world digital assets such as securities, commodities and carbon credits, which by being in custody can be traded.

SECDEX Ecosystem

SECDEX Q&A

Securities, Commodities and Derivatives Exchange (“SECDEX”) is a market infrastructure ecosystem located in the Seychelles. The SECDEX Group business includes an exchange, a central counterparty clearing house (CCP) and a central securities depository with registry authorised and regulated by the Seychelles FSA. The group also includes a digital custodian , which is regulated under the sandbox of the Seychelles FSA and a digital marketplace.

SECDEX has been set up by a team with many years of successful exchange and post-trade experience in fully regulated environments.

The multi-asset hybrid exchange (‘’SECDEX Exchange’’) combines the benefits of a digital exchange with those of a conventional exchange in a fully regulated environment with a complete post-trade market infrastructure to support this hybrid model. SECDEX Exchange focuses on securities, debt, spot commodities and derivatives contracts in traditional and digital form.

SECDEX is unique as it is the first fully-regulated, multi-asset, hybrid market infrastructure ecosystem delivering seamless trading, clearing and settlement based on the strengths of GMEX Group as a founding shareholder combined with the professional services of Digital Partners Network as a co-founding shareholder, which include specialist legal, finance, compliance, corporate structuring, finance, strategic consulting, technology-enabled digital transformation and potential investment through a digital fund. This is game changing, as until now there have been too many intermediaries for these different services, as they have not been offered cost effectively under a single umbrella. This means, that in addition to the listing of traditional securities and derivatives, Security Token Offerings (STOs) can now be undertaken in a regulated, trusted environment with issuance, full professional services support for the tokenisation process covering legal and valuations in addition to capital raising, with listing and secondary trading on SECDEX Exchange.

The SECDEX Group aims to be the premier hybrid (digital and conventional) market infrastructure ecosystem globally and to offer a broad range of asset classes in a fully regulated environment for its members and clients.

Seychelles is a secure investment location with established laws and a business friendly country. Through fiscal discipline and sound management, Seychelles has transformed itself to a middle-income country. Economic policy is guided by the government’s efforts to diversify the economy away from dependence on the tourism sector and towards financial services and technology. This is supported by the introduction of a regulatory “Sandbox” by the Financial Services Authority (“FSA”) and a “National FinTech Strategy” by the Central Bank of Seychelles. The government of Seychelles and associated NGOs are committed to working towards social, ecological, economic and technological sustainability.

Other factors that have contributed to the choice of the Seychelles as country of domicile:-

- Located in the heart of the Indian Ocean with excellent air connectivity to major hubs in the Middle East, Europe, Africa and Asia.

- Politically and economically stable environment.

- Favourable time zone of GMT+4 aligned with the Middle East in between Europe and Asia.

- Fiscal incentives for investments in a range of sectors.

- 96% literacy rate with increasingly educated and skilled workforce.

- 2nd highest GDP per capita in Africa.

- Offers a world class financial centre with no foreign exchange restrictions.

- 2nd for the Ibrahim Index of African Governance, an initiative of the Mo Ibrahim Foundation.

- 2nd in Africa on the Corruption Perception Index (Transparency International).

- 1st in Africa for Human Development Index.

SECDEX Exchange

SECDEX Exchange operates a regulated securities exchange with multi-asset capabilities, which include derivatives. Securities are available in traditional and digital form for primary issuance and secondary trading.

SECDEX Clearing

SECDEX Clearing provides clearing and settlement services for securities and derivatives listed on SECDEX Exchange as a fully regulated Central Counterparty (CCP) clearing house. It is responsible for credit checks, position keep, margining, operational due diligence and initial guarantee of fund deposits with a trusted risk management approach.

SECDEX Depository

SECDEX Depository operates as the regulated central securities depository and registry for securities listed on SECDEX Exchange. It is responsible for safekeeping of securities, supporting deposits and withdrawals as well as dividend and interest processing. SECDEX Depository also acts to facilitate corporate actions such as proxy voting.

SECDEX Digital Custodian

SECDEX Digital Custodian (SDC) is regulated under the sandbox of the Seychelles FSA for a broad range of real-world digital assets such as securities, commodities and carbon credits (“SDC Digital Custodian”).

SECDEX Group Partners include:

GMEX Group

GMEX Group is a leading London based provider of multi-asset exchange and post-trade technology covering the market infrastructure value chain. GMEX is included in the 2018 and 2019 Global Top 100 list of FinTech Companies alongside Amazon and Google. APPG Blockchain (the UK All Party Parliamentary Group for Blockchain) describes GMEX as a top 10 UK Blockchain company.

Investmint

Investmint is based in South Africa. Investmint has developed a platform that connects businesses in need of loans with investors looking to grow their capital. Business owners propose their project through either invoice factoring or project financing – while investors browse, select, then fund.

SECDEX Group consists of the following Seychelles incorporated entities:

- SECDEX Exchange Limited

- SECDEX Clearing Limited

- SECDEX Depository Limited

- SECDEX Digital Custodian Limited

The technology to power the SECDEX Exchange, SECDEX Clearing, SECDEX Depository and SECDEX Digital Custodian is provided and managed by GMEX Technologies Limited, a wholly owned subsidiary of the GMEX Group. This includes the following trading and post-trade solutions:-

- ForumMatch trading system – offering matching via Central Limit Order Book (CLOB), Request for Quote (RFQ) or Auction models.

- ForumPortal primary market front-end – is the tokenisation, registration and primary issuance platform, which can digitise any asset in custody and facilitate secondary trading via ForumTrader.

- ForumTrader trading front-end – a fully functioning web deployable multi-asset, multi-lingual trader workstation and order management system facilitating order routing to the exchange and market data dissemination.

- ForumDetect market surveillance platform – designed for trading venues and trading firms, providing an In-Tray for alert/case management, a real-time replay screen for market event analysis and a set of surveillance reports for post-event review.

- ForumCCP – is a solution for Clearing Houses and Central Counterparties (CCPs), which provides a robust, flexible and cost-effective solution for the real-time clearing, settlement and risk management of traditional financial and non-traditional digital assets.

- ForumCSD – is a solution for Custodians, Central Securities Depositories (CSDs) and Registries, which provides a robust, flexible and cost-effective solution for the real-time registration, clearing, and settlement of traditional financial and non-traditional digital assets.

- ForumCustody – a permissioned blockchain platform designed for settlement, custody and management of traded digital assets. This solution also facilitates inter-bank message flows to facilitate settlement and provides trade data from the ForumMatch exchange trading platform to facilitate balance updates to front-end Order Management Systems (OMS).

SECDEX Conventional & Digital Exchange and Post Trade Process